The returns, which embrace redactions of some private delicate info corresponding to Social Security and checking account numbers, are from 2015 to 2020.

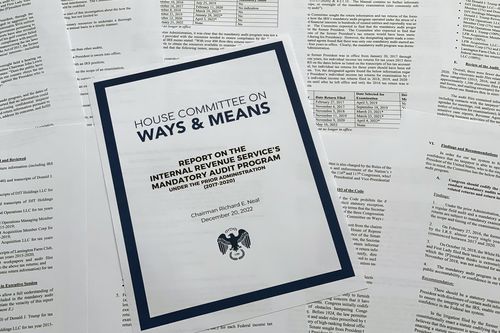

Their launch follows a party-line vote within the House Ways and Means Committee final week to make the returns public.

Committee Democrats argued that transparency and the rule of legislation had been at stake, whereas Republicans countered that the discharge would set a harmful precedent with regard to the lack of privateness protections.

Trump had refused to launch his returns when he ran for president and had waged a authorized battle to maintain them secret whereas he was within the White House. But the Supreme Court dominated final month that he needed to flip them over to the tax-writing Ways and Means Committee.

The launch, simply days earlier than Trump’s fellow Republicans retake management of the House from the Democrats, raises the potential of latest revelations about Trump’s funds, which have been shrouded in thriller and intrigue since his days as an up-and-coming Manhattan actual property developer within the Eighties.

The returns might tackle added significance now that Trump has launched a marketing campaign for the White House in 2024.

They are prone to supply the clearest image but of his funds throughout his time in workplace.

Trump, recognized for constructing skyscrapers and internet hosting a actuality TV present earlier than successful the White House, did give some restricted particulars about his holdings and revenue on necessary disclosure varieties.

He has promoted his wealth within the annual monetary statements he offers to banks to safe loans and to monetary magazines to justify his place on rankings of the world’s billionaires.

Trump’s longtime accounting agency has since disavowed the statements, and New York Attorney General Letitia James has filed a lawsuit alleging Trump and his Trump Organisation inflated asset values on the statements as a part of a years-long fraud. Trump and his firm have denied wrong-doing.

It is not going to be the primary time Trump’s tax returns have been beneath scrutiny.

In October 2018, The New York Times revealed a Pulitzer Prize-winning sequence primarily based on leaked tax data that confirmed that Trump obtained a modern-day equal of a minimum of $US413 million ($608 million) from his father’s actual property holdings, with a lot of that cash coming from what the Times known as “tax dodges” within the Nineteen Nineties.

A second sequence in 2020 confirmed that Trump paid simply $US750 ($1105) in federal revenue taxes in 2017 and 2018, in addition to no revenue taxes in any respect in 10 of the previous 15 years as a result of he typically misplaced more cash than he made.

In its report final week, the Ways and Means Committee indicated the Trump administration could have disregarded a post-Watergate requirement mandating audits of a president’s tax filings.

The IRS solely started to audit Trump’s 2016 tax filings on April 3, 2019 — greater than two years into his presidency — when the committee chairman, Rep. Richard Neal, D-Mass., requested the company for info associated to the tax returns.

By comparability, there have been audits of President Joe Biden for the 2020 and 2021 tax years, stated Andrew Bates, a White House spokesperson. A spokesperson for former President Barack Obama stated Obama was audited in every of his eight years in workplace.

A report from Congress’ nonpartisan Joint Committee on Taxation raised a number of purple flags about points of Trump’s tax filings, together with his carryover losses, deductions tied to conservation and charitable donations, and loans to his youngsters that may very well be taxable presents.

The House handed a invoice in response that may require audits of any president’s revenue tax filings. Republicans strongly opposed the laws, elevating considerations {that a} legislation requiring audits would infringe on taxpayer privateness and will result in audits being weaponized for political acquire.

The measure, accepted principally alongside celebration strains, has little likelihood of turning into legislation anytime quickly with a brand new Republican-led House being sworn in in January. Rather, it’s seen as a place to begin for future efforts to bolster oversight of the presidency.

Republicans have argued that Democrats will remorse the transfer as soon as Republicans take energy subsequent week, they usually warn that the committee’s new GOP chair might be beneath stress to hunt and make public the tax returns of different distinguished folks.

Every president and major-party candidate since Richard Nixon has voluntarily made a minimum of summaries of their tax info out there to the general public. Trump bucked that pattern as a candidate and as president, repeatedly asserting that his taxes had been “under audit” and could not be launched.

Trump’s legal professionals had been repeatedly denied of their quest to maintain his tax returns from the House committee. A 3-judge federal appeals courtroom panel in August upheld a lower-court ruling granting the committee entry.

Trump’s legal professionals additionally tried and failed to dam the Manhattan district legal professional’s workplace from getting Trump’s tax data as a part of its investigation into his business practices, dropping twice within the Supreme Court.

Trump’s longtime accountant, Donald Bender, testified on the Trump Organization’s latest Manhattan prison trial that Trump reported losses on his tax returns yearly for a decade, together with almost $US700 million ($1 billion) in 2009 and $US200 million ($300 million) in 2010.

Bender, a accomplice at Mazars USA LLP who spent years making ready Trump’s private tax returns, stated Trump’s reported losses from 2009 to 2018 included internet working losses from a few of the many companies he owns via the Trump Organisation.

The Trump Organisation was convicted earlier this month on tax fraud expenses for serving to some executives dodge taxes on company-paid perks corresponding to flats and luxurious vehicles.