Earnings launched on Wednesday (Thursday AEDT) present Nvidia’s income grew to almost $12.3 billion within the three months ended January 28 — up from $1.4 billion within the year-ago quarter, a acquire of 769 per cent year-over-year and even stronger development than Wall Street analysts had anticipated.

That end result helped deliver the corporate’s full-year income up greater than 580 per cent from the 12 months earlier.

Nvidia additionally posted fourth-quarter income positive factors of 265 per cent year-over-year, additionally exceeding analyst projections, as the corporate continues to journey the wave of large AI funding.

“Demand is surging worldwide across companies, industries and nations,” CEO Jensen Huang stated in a press release.

In a name with analysts following the report, Huang in contrast the broad adoption of AI know-how to the beginning of a brand new industrial revolution.

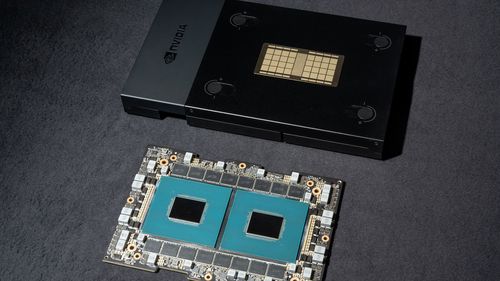

Nvidia is essential to the burgeoning AI area. The American chipmaker is unmatched in producing processors that energy synthetic intelligence programs, together with for generative AI, the buzzy new know-how that may create textual content, pictures and different media.

Nvidia accounts for round 70 per cent of AI semiconductor gross sales, whilst Meta, Amazon, IBM and Microsoft have all begun producing a few of their very own chips, in line with Dan Morgan, vp at Synovus Trust Company.

Sales from the corporate’s core knowledge centre business grew 409 per cent year-over-year to a file $18.4 billion within the fourth quarter, due to partnerships with infrastructure giants like Google, Amazon and Cisco.

But the corporate’s hovering inventory value over the previous 12 months — shares grew round 230 per cent in 2023 — means Nvidia is now deeply essential to the broader market, too. In a be aware on Tuesday, Goldman Sachs analysts referred to as Nvidia “the most important stock on planet earth”.

Nvidia was the top-performing S&P 500 inventory in 2023.

Nvidia’s shares jumped practically 7 per cent in after-hours buying and selling following Wednesday’s report.

But some shareholders fear that large development cannot final without end. And US restrictions launched final 12 months on exports of superior AI chips to China, which affected merchandise like Nvidia’s H800 and A800 chips, threaten to choke off entry to an enormous and fast-growing market.

The firm acknowledged that knowledge centre gross sales to China “declined significantly” within the January quarter due to the restrictions, though different areas nonetheless contributed to robust development within the unit.

“However, if Nvidia does not find a long-term workaround to the restrictions, it could start to trickle down into future growth,” Morgan stated in emailed commentary forward of Wednesday’s report.

Nvidia executives stated on the earnings name that the corporate has already begun transport various chips to China that do not violate the restrictions. CFO Colette Kress stated China represented a mid-single-digit share of its general knowledge centre business within the fourth quarter and is anticipated to stay in the same vary within the present quarter.

Despite the China jitters, others on Wall Street imagine the corporate nonetheless has loads of room to run.

“The outlook for Nvidia is positive as AI chip competition from Intel, AMD, Meta and Microsoft could be months away while demand for Nvidia chips is only surging,” Insider Intelligence senior analyst Gadjo Sevilla stated in a be aware earlier this week.

For now, the corporate says demand for its superior AI chips continues to “exceed supply,” Kress stated on Wednesday’s name.

“Building and deploying AI solutions has reached virtually every industry.”

Ensuring that offer meets the booming demand could also be a problem for the corporate because it heads into this 12 months. However, the corporate’s “cycle times are improving … overall, our supply is increasing very nicely,” Huang stated.

The firm stated on Wednesday that it initiatives income for the present quarter to come back in round $24 billion, which might mark a 233 per cent enhance from the year-ago quarter and is forward of what Wall Street had anticipated.

Source: www.9news.com.au