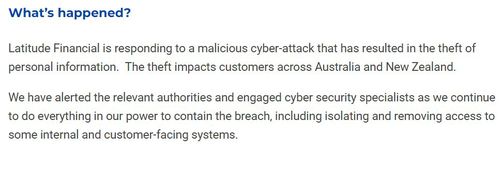

When the corporate first reported the breach, the variety of affected prospects was round 330,000, nevertheless right this moment an announcement says “regrettably our review has uncovered further evidence of large-scale information theft affecting customers (past and present) and applicants across Australia and New Zealand”.

At this stage, the corporate is but to stipulate simply how far-reaching the assault on its programs is however says “our people are working urgently to identify the total number of customers and applicants affected and the type of personal information that has been stolen”.

Of concern for a lot of Australians would be the reality this breach now seems to incorporate each previous and current prospects, and previous and current candidates.

This means individuals who utilized for credit score in any manner with Latitude might be affected.

Those prospects and candidates would cowl at the very least seven years, as Latitude says it’s “required to retain account records for at least seven years after an account is closed. This is to comply with Anti-Money Laundering and counter-terrorism financing laws”.

Most alarming although is the reference to “copies of driver’s licences”, which is much worse than only a driver’s licence quantity.

Many Australians realized throughout the Optus breach that, in actual fact, the quantity alone was not sufficient to lead to widespread fraud or identification theft.

That’s as a result of monetary programs now use a second quantity – the cardboard quantity – to confirm an ID doc.

With copies of an precise licence, a hacker can basically apply for credit score in your behalf.

Latitude says it is going to cowl the price of any doc alternative, and that it’s providing IDCARE help and a devoted buyer contact centre for these prospects affected.

The query is: who’s affected and what number of of them are there?

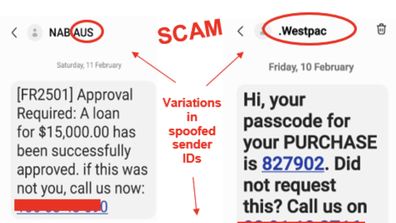

The textual content message to look out for that would trick virtually anybody

Source: www.9news.com.au