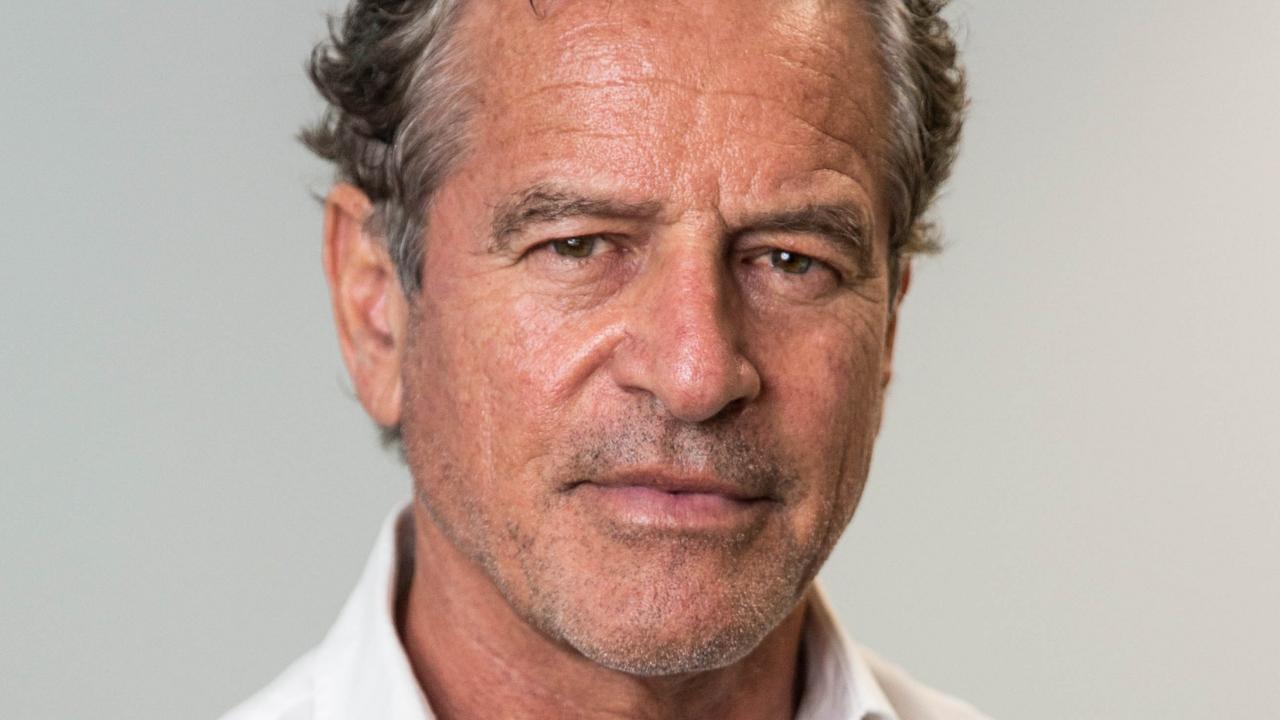

Finance guru Mark Bouris says he’s listening to rumours of distressed householders quietly promoting their properties in a “bad indicator” for the market.

The govt chairman of mortgage dealer Yellow Brick Road on Wednesday issued a dire prediction for subsequent month’s Reserve Bank assembly, saying it was “more than likely” the board would elevate charges for the twelfth time.

“Given what’s going on overseas, the UK just put their rates up, the US are considering putting their rates up, irrespective of the fact that inflation looks like it’s declining, I think there’s every chance of a couple more rate rises,” he advised Sky News.

“Inflation is proving to be extraordinarily stubborn at 7 per cent.”

His feedback got here as recent information confirmed wages grew to a decade-high of three.7 per cent within the 12 months to March, up from 3.3 per cent.

But the 0.8 per cent quarterly improve within the Australian Bureau of Statistics’ wage value index was barely beneath economists’ forecasts of 0.9 per cent, weighing in opposition to the probability of the RBA elevating charges once more as early as June.

The RBA elevated the official money fee to three.85 per cent in May to tame inflation, having paused in April following 10 consecutive will increase.

Markets have priced in a 58 per cent likelihood of one other fee rise by August, The Australian Financial Review reported on Tuesday, sharply rising after the discharge of the RBA’s May 2 board assembly minutes.

“Members also agreed that further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve,” the minutes stated.

Mr Bouris stated after studying the RBA minutes he “didn’t get any encouragement whatsoever in terms of thinking maybe we’re at a pause stage”.

“Actually on the other side, the feeling I got from it was that they’re more than likely to put rates up,” he stated.

But he stated he didn’t know “whether our economy can withstand” one other 95 foundation factors of will increase to 4.8 per cent, as some have predicted.

“That would definitely put us into a recession,” he stated.

He stated that money fee would pressure a wave of mortgage defaults.

“I was talking to a well known auctioneer in Sydney yesterday and he said to me that whilst we’re not seeing mortgagee sales, he’s actually noting that, I don’t know what they are called, but there’s some person sitting between the borrower and the lender who is coming out and encouraging the borrower to put their property on the market,” he stated.

“Not as a mortgagee sale because as soon as you put it on as a mortgagee sale you get nailed … but they’re trying to get an orderly price. That’s a bad indicator – I don’t like the sound of that.”

In a separate interview with Nine News, Mr Bouris stated the problem going through the RBA board was that regardless of wages going up, Australia was going through a productiveness decline.

“Their argument is this – if wages go up today … but if productivity doesn’t go up, then [the board is] saying that the unit cost … if it is a coffee shop, et cetera … the owner of (the) business will put up their prices which will cause inflation,” he stated.

“Because Australia is suffering from a productivity downfall. So I pay more wages. ‘OK, can you work a bit harder? Produce a bit more?’ But that’s not happening.

“This is what the RBA is talking about – what is the cost of each unit of output? That is a function of wages and everything else. Plus how many units you produce.

“If you can produce more, it doesn’t matter if wages go up. But the problem with Australia, we’re suffering our biggest downturn in productivity for 20 years.”

As charges rise, a rising variety of householders are refinancing, with the Banking Association receiving as much as 2500 requests per day.

“If you think you’ve got an interest rate that’s too high, go and try and get a better deal,” Mr Bouris stated.

“There is always a better rate, always a better deal out there and borrowers are realising that just because they can’t afford their current position or are under stress, what will happen if they reduce their rate?”

But he warned “what worries me” is that folks would in the end find yourself paying extra curiosity in the long term by extending their mortgage.

“The moment you refinance, you take your loan back to a 30-year period,” he stated.

“So if you’ve only got 20 years left on your loan, 25 years left, you go and refinance and it goes back to 30 years. So you’re basically pushing the amount of time and you’ll actually pay more interest over the next 30 years than you would have over the next 20 years, because you’re paying interest – albeit a slightly lower rate – but over a longer period of time.”

Still, he stated for a lot of debtors feeling trapped the best choice was to refinance.

“While interest rates are high, the repayments per month will be lower than when interest rates go down,” he stated.

“They will come down eventually, then you have more money in the pocket to start paying your loan off faster.

“Then you’ll effectively reduce your 30 years back down to 25 years – but everyone’s got to be aware of that – they’ve got to know the strategy and put the strategy into play.”

frank.chung@news.com.au

Source: www.news.com.au