Employers are searching for to postpone the anticipated enhance in contributions to the Social Security System (SSS) and Philippine Health Insurance Corporation (PhilHealth) in 2023 given that companies are simply recovering from the results of the pandemic.

According to Maki Pulido’s report on “24 Oras,” by 2023, the SSS contribution will probably be elevated by 1% from 13% to 14%.

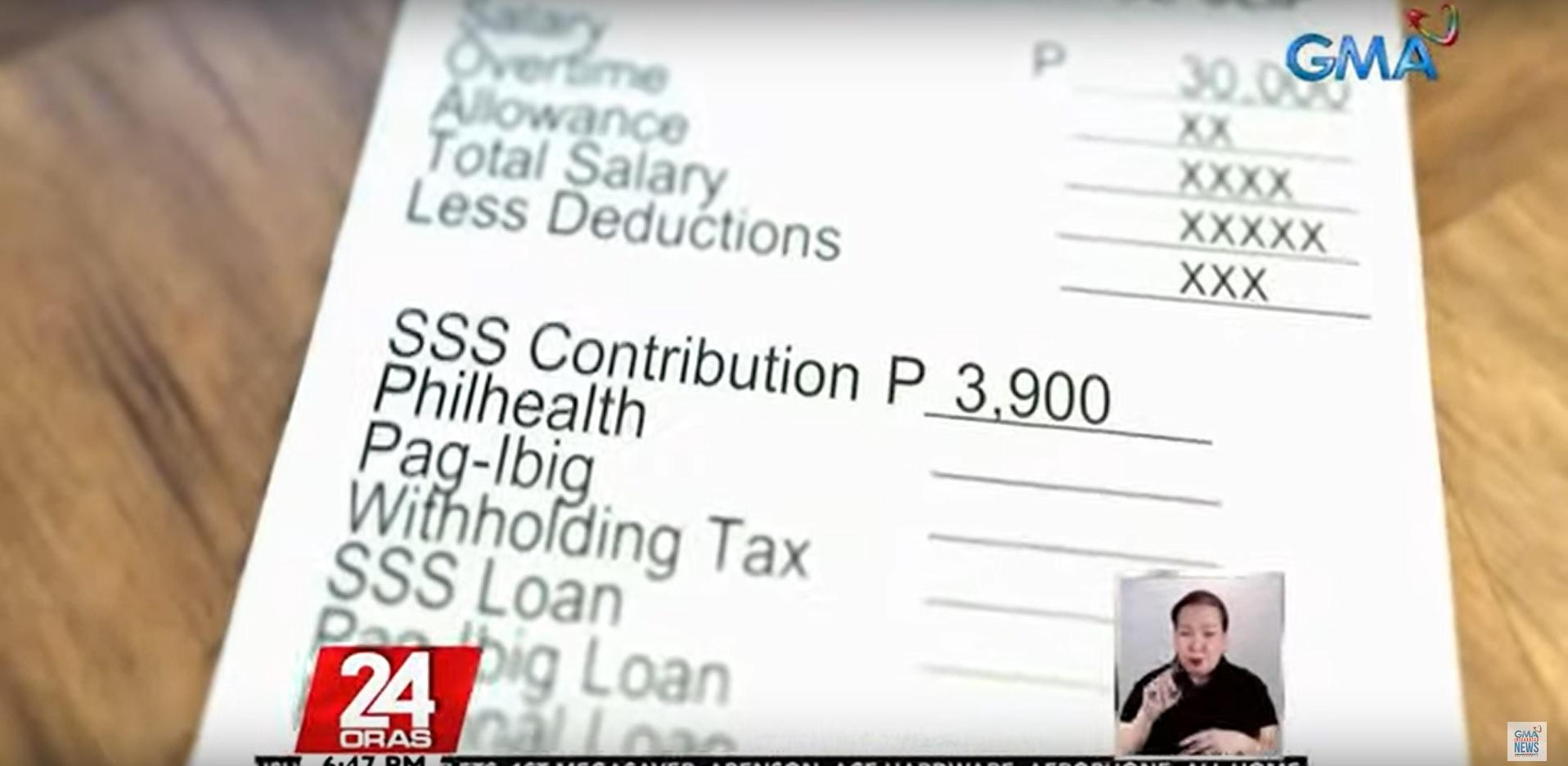

For instance, with a wage of P30,000 per 30 days, from a P3,900 SSS contribution, it is going to be P4,200 or a further cost of P300, which will probably be shouldered by the employer.

This is as a result of enhance of employers’ share by 1% – from 8.5% to 9.5% – whereas the workers’ share will stay at 4.5%.

In January 2023, for a P30,000 wage, the employer’s contribution will probably be P2,850, and the worker’s contribution will stay at P1,300.

The gradual enhance in SSS contribution is beneath Republic Act No. 11199, or Social Security Act of 2018, which Former President Rodrigo Duterte signed to lift the contribution to fifteen% by 2025.

The enhance favors most SSS members, however some employers, such because the Employers Confederation of the Philippines (ECOP), are asking for its postponement.

“Ninety percent of our enterprises are micro. Eh 50% diyan, nagsara during pandemic, maraming hindi pa nagbubukas. Nadi-discourage tuloy magbukas yung iba” mentioned Sergio Ortiz-Luis, ECOP President.

Meanwhile, PhilHealth’s contribution will enhance to 4.5% from 4%.

This means if you happen to earn P10,000 month-to-month, from P400 contribution will enhance to P450. The price will probably be divided between the employer and the worker.

The enhance on this cost is predicated on the common healthcare regulation that goals to extend the PhilHealth contribution till it reaches 5% by 2024.

“The increase in contribution will help fund additional benefits that we are crafting now,” mentioned PhilHealth spokesperson Dr. Shirley Domingo. — Sherylin Untalan/DVM, GMA News