It was a optimistic begin to the week for the Australian share market which rallied on Monday as buyers raised their bets that the Federal Reserve and different central banks had completed elevating rates of interest.

Josh Gilbert, market analyst at eToro stated the market was more and more optimistic of a fee minimize regardless of makes an attempt by some Federal Reserve policymakers, together with chairman Jerome Powell, to dampen expectations.

“The market is believing that rate cuts are coming in the first half of 2024,” Mr Gilbert stated.

“Powell and other Federal Reserve members are still trying their best to break down market expectations on it, but market optimism is just running away.”

While initially climbing to a 12-week excessive after markets opened, the benchmark S & P/ASX200 added 0.7 per cent, or 51.5 factors, to succeed in 7,124.7 factors on the closing bell.

Meanwhile the broader All Ordinaries climbed the same quantity, reaching 7,336.1 factors on the finish of buying and selling.

The Australian greenback completed decrease to purchase US66.58c on the shut of markets.

Nine of the 11 business sectors completed within the inexperienced, with curiosity rate-sensitive tech and actual property shares the very best performers.

Miners additionally helped carry the benchmark with ASX heavyweight BHP rising 1.7 per cent to $47.14. Rio Tinto and Fortescue firmed 1.6 per cent and 0.4 per cent, respectively.

Also within the supplies sector, gold spot costs soared above $US2100 an oz., surpassing the earlier excessive set on August 7, 2020.

Miners of the valuable steel tracked the rise within the commodity’s worth, with Northern Star Resources including 3.7 per cent to $12.90, Newmont growing 2.9 per cent to $62.54, and Regis Resources climbing 1.8 per cent to $1.98.

Tech shares had been the very best performers on the benchmark, including 1.9 per cent. Sector heavyweights Xero climbed 1.7 per cent to $102.80, Wisetech rose 1.9 per cent to $67.43, and Altium jumped 1.5 per cent to $45.32.

Energy shares completed within the pink as world oil costs continued to slip on Monday as investor scepticism concerning the depth of provide cuts by the OPEC+ cartel continued with Brent Crude sliding in the direction of $US78 a barrel.

Woodside sank 1.6 per cent to $30.35 and Santos fell 1.2 per cent to $6.82.

Investors are carefully watching the Reserve Bank’s last board assembly for 2024, with markets pricing in close to 100 per cent odds that the central financial institution will preserve charges on maintain at 4.35 per cent.

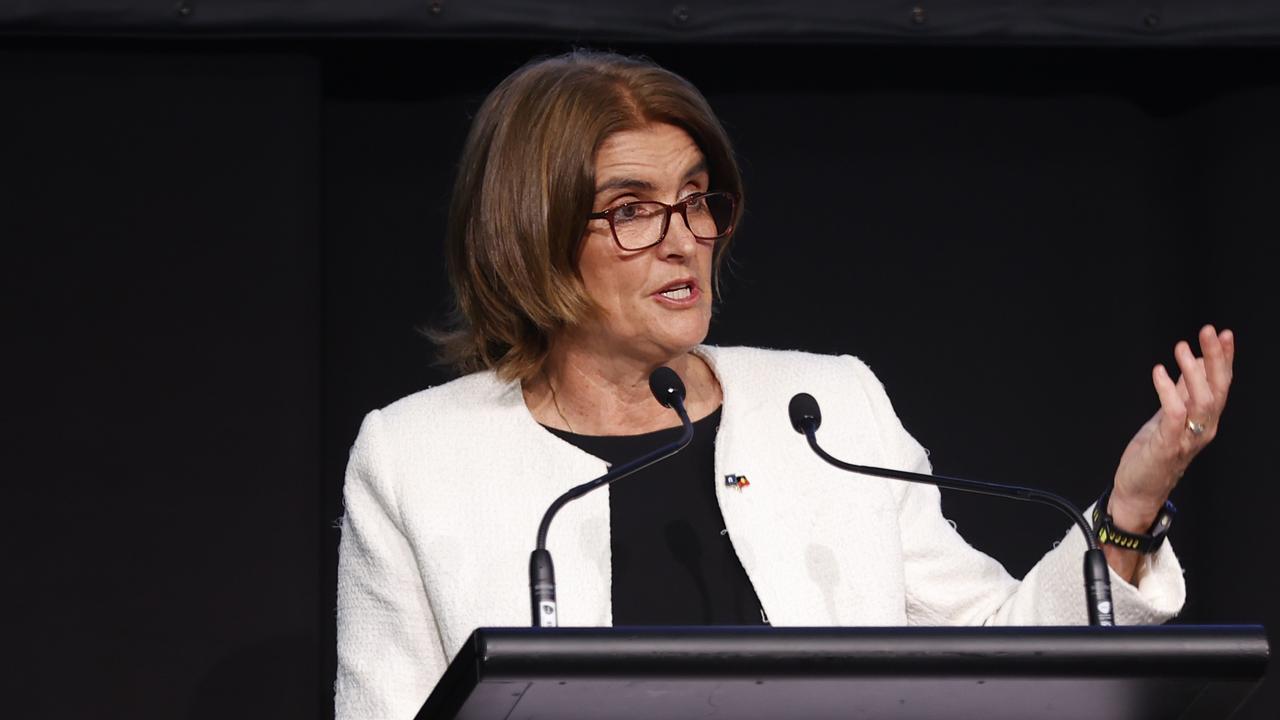

Mr Gilbert added that current information flows, together with month-to-month inflation and retail gross sales information, had “little bit of weight” off governor Michele Bullock’s shoulders with the central financial institution afforded additional time to evaluate the impression of fee hikes thus far.

“I think if the data continues to move in the right direction, it is good news,” Mr Gilbert stated, earlier than including {that a} additional hike was attainable.

“I don’t think the battle is necessarily done.”

“I doubt we’ll see any sort of lighter tone from Bullock in tomorrow’s statement … hawkish rhetoric is going to be front and centre.”

In firm news, a $20bn takeover bid for Origin Energy failed with the corporate’s largest shareholder AustralianTremendous rejecting the supply lobbed by Brookfield and EIG. AustralianTremendous has a 17 per cent stake in Origin, which was sufficient to dam the bid that required assist from 75 per cent of buyers. The vitality retailer dropped 3.9 per cent to $7.86.

Metcash, proprietor of IGA, Total Tools and Mitre 10, reported optimistic half-yearly outcomes. Despite recording rising prices and weak efficiency in its {hardware} division, a powerful rise in its meals earnings noticed group income improve 1.3 per cent to $7.8bn. Shares traded 1.1 per cent greater to $3.59.

Shares in Liontown Resources added 0.4 per cent to $1.36. The lithium producer stated it had secured a port companies and entry settlement with the Mid West ports authority in Western Australia.

Endeavour Group elevated 1.8 per cent to $5.09 after UBS analysts upgraded the inventory to a “buy” ranking. Analysts stated the considerations concerning the regulatory hurdles confronted by the lodge and gaming operator weren’t as dangerous as anticipated.

Originally revealed as Australian share market rallies forward of Reserve Bank December charges name

Source: www.dailytelegraph.com.au