The Australian share market completed flat on Thursday because the benchmark was dragged decrease by heavy losses in well being shares.

The S & P/ASX200 rose simply 2.6 per cent to shut at 7,091. The All Ordinaries climbed barely larger, growing 6.1 factors to 7287.4.

On the benchmark, seven of 11 sectors completed the inexperienced with healthcare shares the clear laggard, tumbling 4.5 per cent.

Early within the buying and selling session, shares had rallied after a constructive lead from Wall St as merchants turned more and more assured the US Federal Reserve had completed elevating rates of interest for now following the discharge of its contemporary board minutes.

In the minutes, Fed officers “noted that it was important to balance the risk of overtightening against the risk of insufficient tightening.”

As a outcome the Dow Jones index rose by 66 factors or 0.2 per cent. The S & P 500 index gained 0.4 per cent and the Nasdaq index added 97 factors or 0.7 per cent.

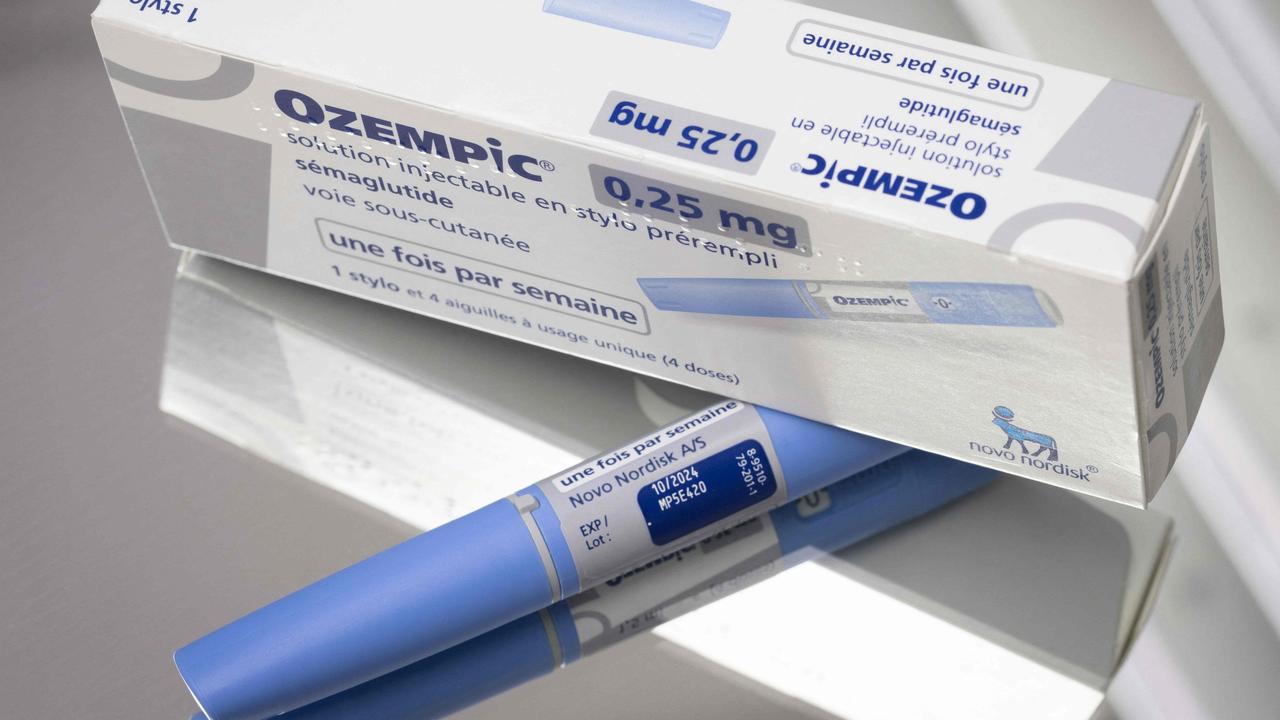

Back dwelling, well being sector heavyweight CSL tumbled 6.3 per cent to $238.24 a share after news that weight reduction drug Ozempic may compete with the agency’s kidney illness therapy merchandise. Separately, Fisher & Paykel sank 4.4 per cent to $19.75.

Financial shares have been the highest performers, with the large 4 banks all rising. Commonwealth Bank jumped 1 per cent to $101.60, Westpac rose 0.9 per cent to $21.63, NAB rose 0.9 per cent to $29.56 and ANZ superior 0.8 per cent to $25.86.

Among commodities, the November contract for iron ore on the Singapore change rose 0.8 per cent to shut at $US113.40 a tonne. Meanwhile the bump in crude oil costs appeared brief lived with Brent crude falling 0.2 per cent to $85.64.

In firm news, takeover goal Liontown Resources fell 1.7 per cent to $2.87 after the lithium miner prolonged the due diligence interval for Albemarle’s $4.2bn buyout.

Shares in Redbubble soared 30.4 per cent to 60c, the very best day for the web market since June 2020, following its announcement that underlying money stream rose $16.9m to a constructive $700,000 money stream place.

Tabcorp shares fell 6.2 per cent to 91.5¢ after income dropped 6.1 per cent within the September quarter.

Originally revealed as Australian share market flat as well being shares plummet

Source: www.dailytelegraph.com.au