RIYADH — Chinese President Xi Jinping touched down in Saudi Arabia on Wednesday for a go to that’s prone to deal with vitality ties but additionally follows months of tensions with the United States.

Xi, just lately re-anointed as chief of the world’s second largest financial system, arrived within the capital Riyadh, Chinese and Saudi state media stated, for a three-day go to that can embrace talks with the Saudi rulers and different Arab leaders.

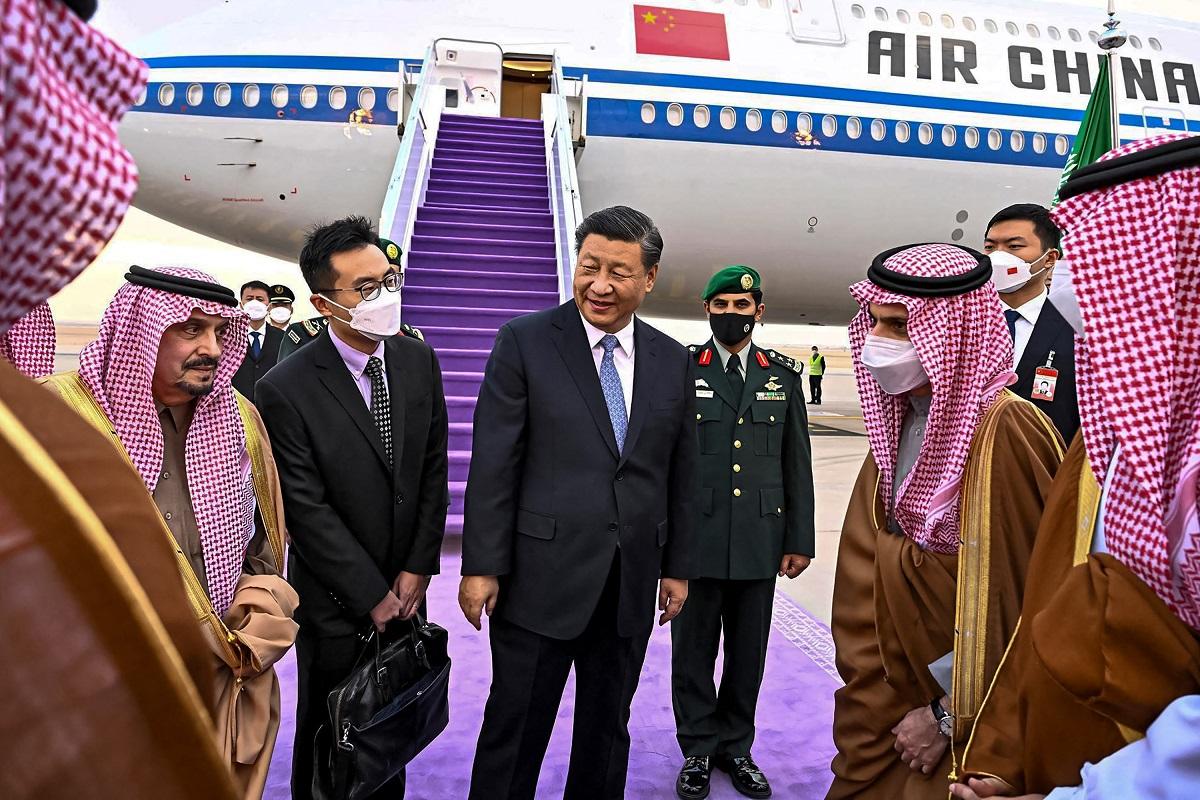

Saudi Foreign Minister Prince Faisal bin Farhan and Riyadh Governor Prince Faisal bin Bandar had been amongst those that welcomed Xi on the airport, the place a ceremonial purple carpet was laid out from the steps of the aircraft.

On main roads in Riyadh, the red-and-gold Chinese flag alternated with the inexperienced Saudi emblem.

China is the highest buyer for oil from Saudi Arabia, the main exporter of crude, and each side seem eager to broaden their relationship at a time of financial turmoil and geopolitical realignment.

The journey—solely Xi’s third abroad journey for the reason that coronavirus pandemic started, and his first to Saudi Arabia since 2016—comes after US President Joe Biden’s go to in July, when he pleaded in useless for increased oil manufacturing.

It will function bilateral conferences with Saudi King Salman and Crown Prince Mohammed bin Salman, the de facto ruler, in addition to a summit with the six-member Gulf Cooperation Council and a wider China-Arab summit.

Oil markets

The program represents the “largest-scale diplomatic activity between China and the Arab world since the founding of the PRC,” or People’s Republic of China, international ministry spokeswoman Mao Ning stated on Wednesday.

The official Saudi Press Agency stated the dominion accounted for greater than 20 p.c of Chinese funding within the Arab world between 2005 and 2020, “making it the biggest Arab country to receive Chinese investments during that period.”

Oil markets are anticipated to be a high agenda merchandise for talks between China and Saudi Arabia, particularly given the turbulence the markets have skilled since Russia invaded Ukraine in February.

The G7 and European Union on Friday agreed to a $60-per-barrel worth cap on Russian oil in an try and deny the Kremlin struggle assets, injecting additional uncertainty into the markets.

On Sunday, the OPEC+ oil cartel led collectively by Saudi Arabia and Russia opted to maintain in place manufacturing cuts of two million barrels per day authorised in October.

Saudi and Chinese officers have offered scant details about the agenda, although Ali Shihabi, a Saudi analyst near the federal government, stated he anticipated “a number of agreements to be signed.”

Beyond vitality, analysts say leaders from the 2 nations will doubtless focus on potential offers that would see Chinese companies develop into extra deeply concerned in mega-projects which can be central to Prince Mohammed’s imaginative and prescient of diversifying the Saudi financial system away from oil.

They embrace a futuristic $500 billion megacity often called NEOM, a so-called cognitive metropolis that can rely closely on facial recognition and surveillance expertise.

Tensions with Washington

The OPEC+ manufacturing cuts authorised in October represented the most recent blow to the longtime partnership between Saudi Arabia and the United States, which stated they amounted to “aligning with Russia” on the struggle in Ukraine.

Xi’s go to is predicted to be intently watched in Washington, which entered into what is commonly described as an oil-for-security partnership with Saudi Arabia in the direction of the tip of World War II.

While the Biden administration has smarted over the manufacturing cuts, Riyadh has at instances accused the United States of failing to carry up the safety finish of the discount, notably after strikes in September 2019 claimed by Yemen’s Huthi rebels quickly halved the dominion’s crude output.

China and Saudi Arabia already work collectively on arms gross sales and manufacturing.

Yet analysts say Beijing can’t present the identical safety assurances Washington does—nor does it want to.

Nevertheless, if the Saudis are “looking to extract more security guarantees from the US… signaling that they have the opportunity of strengthening ties with China is something that suits them well,” stated Torbjorn Soltvedt, of the danger intelligence agency Verisk Maplecroft.

The GCC-China summit shall be held in Riyadh on Friday, the bloc stated in a press release. — AFP