Stock markets wrapped up their worst performances in years on Friday earlier than heading into 2023 below recession fears following Russia’s invasion of Ukraine, excessive inflation and rising rates of interest.

Both US and European indices closed their remaining periods of the 12 months within the pink. For the 12 months, Frankfurt was down greater than 12 per cent and Paris misplaced 9.5 per cent for his or her worst performances since 2018. London, nevertheless, was up 0.9 per cent in 2022 because the vitality sector was buoyed by hovering vitality costs.

It was Wall Street’s worst annual drop since 2008, with the S&P 500 index down round 20 per cent and the tech-heavy Nasdaq shedding about 30 per cent for the 12 months.

Equities have been slammed because the US Federal Reserve, European Central Bank and Bank of England aggressively lifted rates of interest in a bid to sort out rampant shopper value rises. The transfer carries the chance of sparking recession as greater borrowing prices gradual financial exercise.

US tech firms have been hit significantly laborious as they’re often boosted by decrease rates of interest.

The MCSI World Equity Index has misplaced nearly a fifth in its worst annual efficiency since 2008, when markets have been ravaged by the worldwide monetary disaster.

Asia-Pacific markets completed their final periods principally within the inexperienced on Friday. But for the 12 months, Hong Kong tanked 15.5 per cent and Shanghai dived 15.1 per cent within the greatest annual slumps since 2011 and 2018, respectively.

Covid spiked as soon as extra in China in December, after Beijing relaxed its strict curbs within the face of uncommon public outcry. The surge has additionally prompted worries in regards to the impression on stretched international provide chains.

Tokyo plunged 9.4 per cent within the first annual fall since 2018 however the Bank of Japan maintained its ultra-easy financial coverage, in distinction with different central banks, to assist its fragile financial system.

‘Pitiful end to miserable year’

“It’s shaping up to be a pitiful end to a miserable year in stock markets,” OANDA buying and selling platform analyst Craig Erlam informed AFP.

He stated 2022 had “brought an end to an era” of low rates of interest that fuelled tech and crypto booms.

“That’s been replaced with soaring inflation and interest rates, immense economic uncertainty and the reshaping of energy markets in the aftermath of the Russian invasion of Ukraine,” Erlam added.

In commodities, oil costs rallied in 2022 with Brent gaining about 10 per cent and the West Texas Intermediate including round seven per cent.

However, they continue to be considerably beneath peaks struck in March on provide woes after key producer Russia invaded its neighbour, sending pure gasoline costs additionally spiking.

Britain and different main economies now face the probably prospect of grim recessions subsequent 12 months, as customers and companies battle rampant inflation and rising charges after years of ultra-low borrowing prices.

“The most important take of the year is: the era of easy money ended, and ended for good,” famous SwissQuote analyst Ipek Ozkardeskaya.

“And given that there is still plenty of cheap central bank liquidity waiting to be pulled back, the situation may not get better before it gets worse,” she stated.

“Recession, inflation, stagflation will likely dominate headlines next year.” London was down 0.8 per cent and Frankfurt shed 1.1 per cent in half-day periods forward of the New Year vacation. Paris closed 1.5 per cent decrease.

On Wall Street, the Dow ended 0.2 per cent decrease whereas the tech-heavy Nasdaq shed 0.1 per cent.

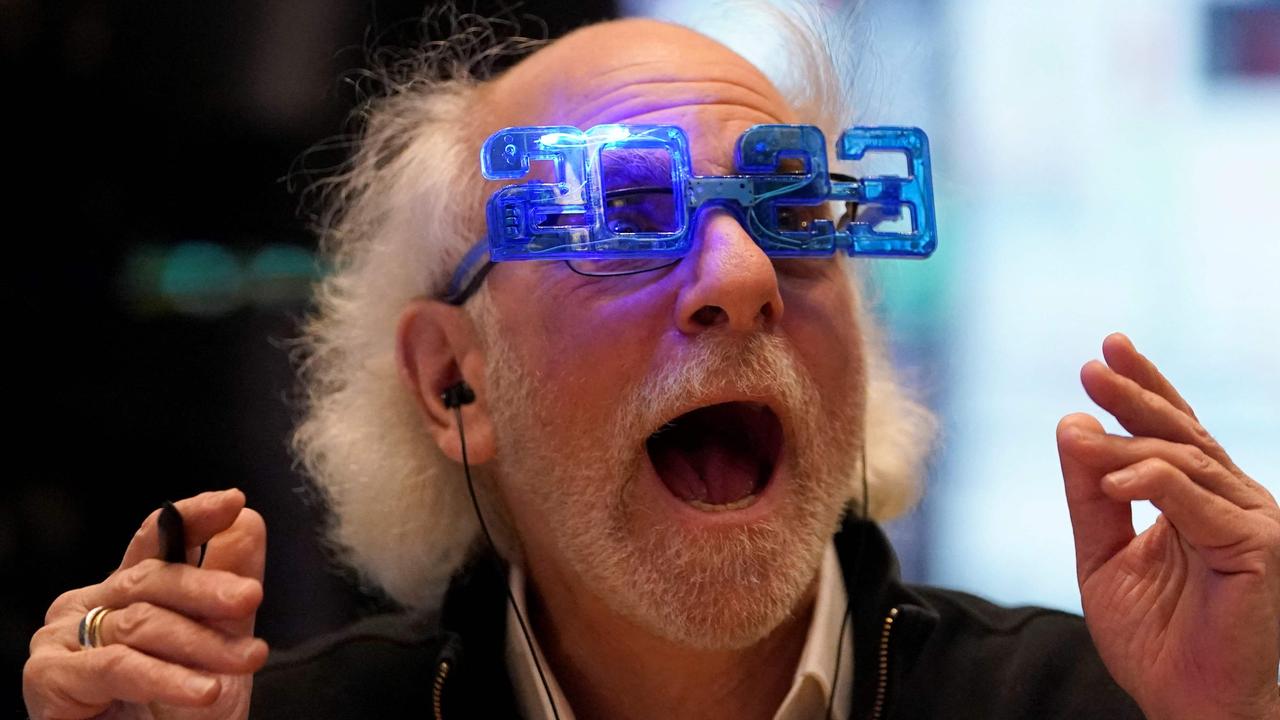

“It would appear that people have checked out for the year and have settled back into holiday mode for New Year celebrations,” Erlam stated.